Blackrock Vs Vanguard Aum. This only increases their competitive advantage. Hes from a philanthropists family that works for the absolute elite.

One should invest based on their need ability and willingness to take risk - Larry Swedroe Asking Portfolio Questions. Vanguard has stated it will not compete with BlackRock to sell annuities through its TDFs according to a spokeswoman for the 73 trillion AUM asset manager. For example while there are more than 3000 shareholders in Pepsi Co Vanguard and Blackrocks holdings account for nearly one-third of all shares.

Vanguards total assets under management AUM increased more than sevenfold in the decade and a half since 2005 reaching a value of 73.

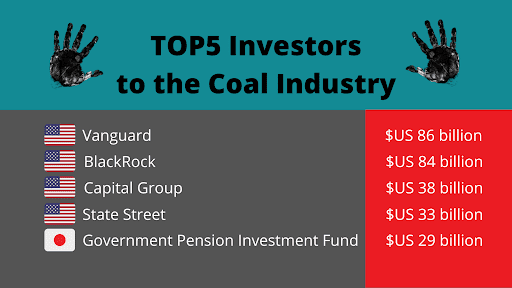

Although BlackRock has a higher figure for assets under management The Vanguard Group is the largest shareholder of BlackRock shares. The wealthiest families in the world are associated with Vanguard Group funds. Boston-based Fidelity recorded DC assets under management of 6202 billion up 13 while third-place BlackRock New York had 5848 billion in. If Vanguard BlackRock State Street etc are going to manage portfolios of ETFs without external management fees we want to be able to do that too Michael Jones.